Credit Monitoring Over Payouts? FTC and Equifax Encourage Breach Victims To Forgo Payouts Promised In Settlement

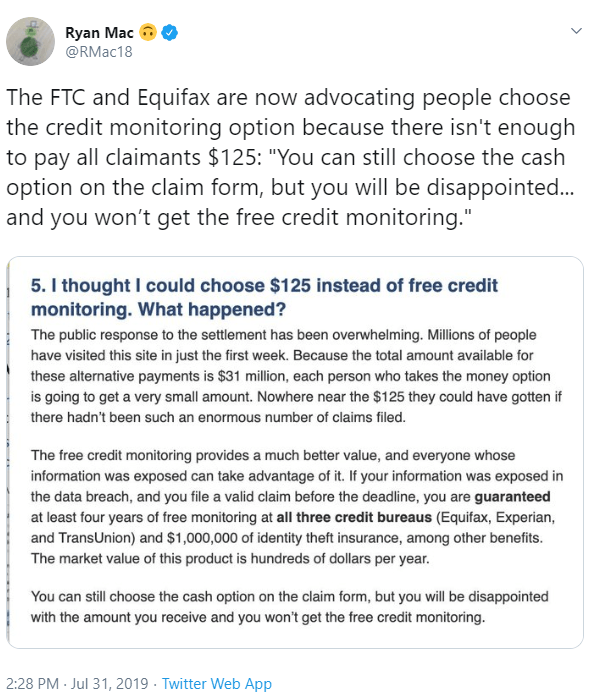

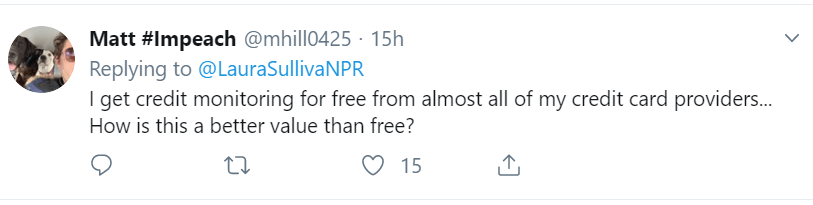

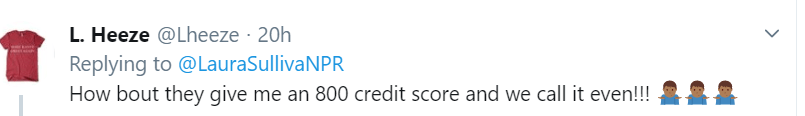

On its website today, the FTC is encouraging people to choose credit monitoring over a $125 payout, as a “far better value.’’

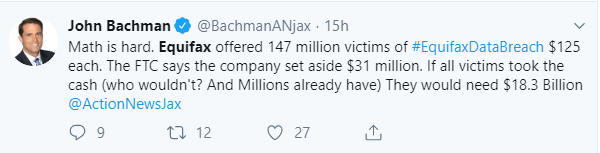

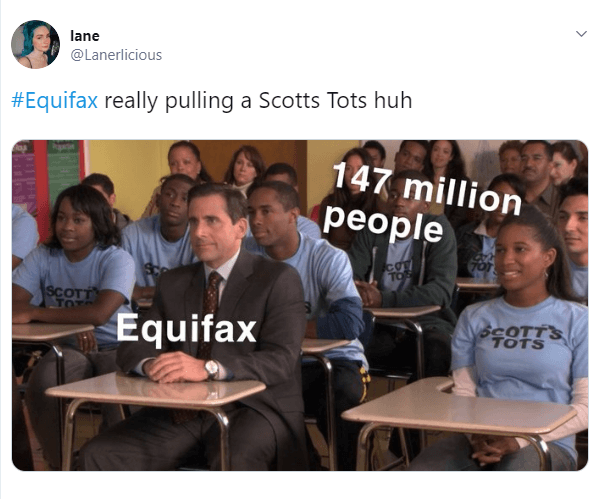

The FTC warns that the payout will likely be reduced if millions apply and claims exceed the $31 million cap reached in a settlement with Equifax.

Credit monitoring is a “far better value,’’ the FTC states, “because each person who takes the money option is going to get a very small amount.”

The FTC statement is likely true.

According to USA today, if the $31 million claims fund is drained, the amount each person gets will drop as the money is distributed proportionally.

“If more than 248,000 claims are approved – less than one-fifth of 1 percent of the 147 million consumers affected – claimants will get less than $125,” the paper reported.

“In addition, you can seek reimbursement of $25 per hour for time spent dealing with the breach. You can claim up to 10 hours without supplying supporting documentation. But if you are hoping to collect $250, you may be disappointed. Again, the payments depend on how many people apply. There is another pool of $31 million set aside for these claims, and the payout will be reduced for everyone proportionally depending on how many apply.”

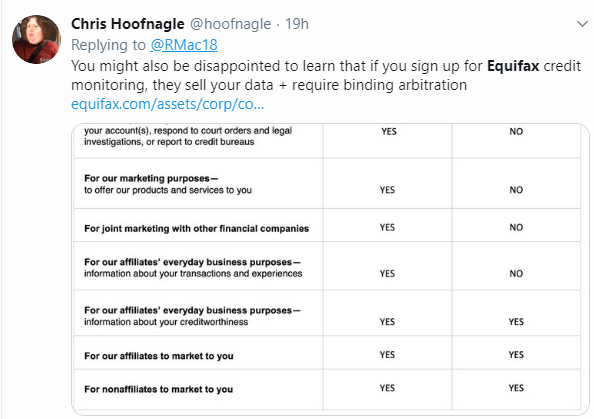

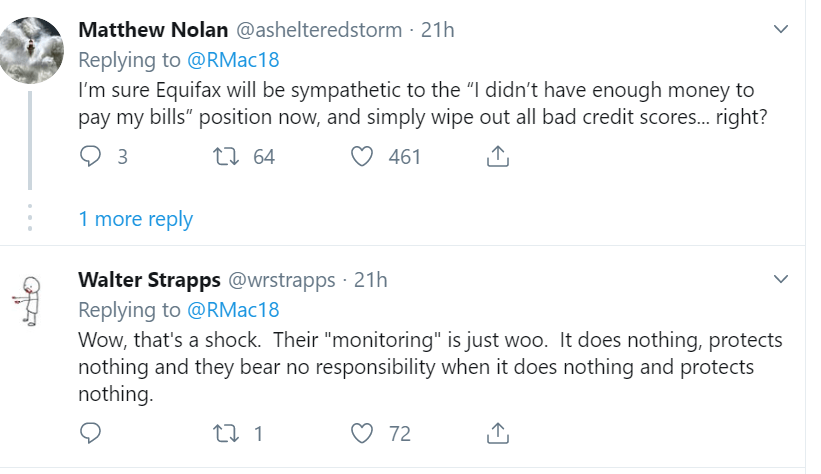

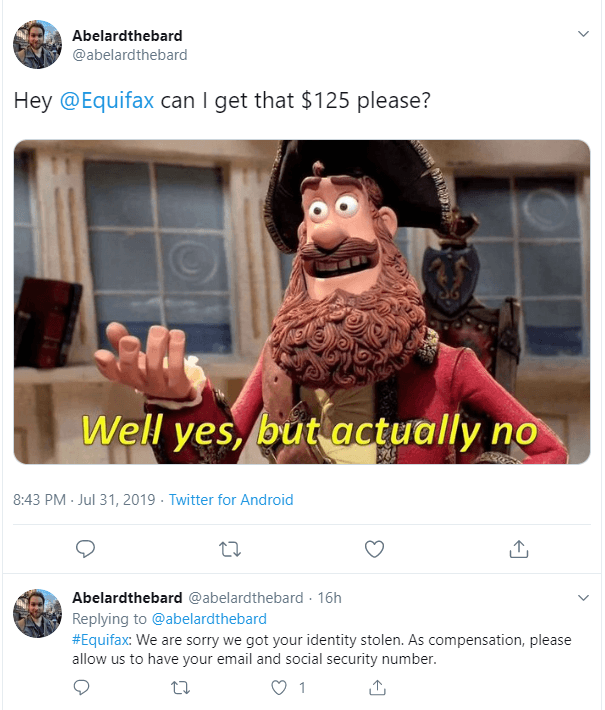

Here are some sample responses (click on the images to enlarge them).

To get Equifax’s take on the issue and the value of credit monitoring, click here.

The FTC announcement can be found here.

Get a curated briefing of the week's biggest cyber news every Friday.

Turn your employees into a human firewall with our innovative Security Awareness Training.

Our e-learning modules take the boring out of security training.

Intelligence and Insights

Are You Prepared for an AI-Powered Cyber Attack?

AI Privacy Risks