Why Performing a Business Impact Analysis is Important for Banks

By Divyansh Arora, Information Security Manager, ERMProtect

Understanding the Role of BIA in the Banking Sector

Business Impact Analysis (BIA) is a structured process designed to identify the critical functions and processes within an organization. According to the Federal Financial Institutions Examination Council (FFIEC), BIA helps entities such as banks and financial institutions pinpoint vulnerabilities in their essential processes that could hinder them from meeting their business objectives during a disaster.

Recent events, like the devastating wildfires in California, demonstrate that disasters can strike anywhere and at any time. Therefore, it is crucial for banks to establish a comprehensive Business Continuity Plan (BCP), with the first step being the execution of a BIA.

In this article, we will explore the unique challenges banks face when conducting a BIA, real-world scenarios we have encountered over the years during BIAs and IT risk assessments, the practical steps involved in performing a BIA, and the common pitfalls to avoid during the process.

Unique Challenges Banks Face

Every industry faces unique challenges, and the banking sector is no exception. IT risk assessments must become a cornerstone of financial institutions' pursuit of cybersecurity. Banks operate in a highly dynamic and sensitive environment, making them particularly vulnerable to a range of threats. These include cyberattacks, regulatory pressures, operational disruptions, and reputational risks.

To effectively address these challenges and maintain resilience, banks must adopt a proactive and multi-faceted approach that includes:

- Establishing a robust and reliable digital infrastructure to handle increasing transaction volumes and mitigate system vulnerabilities.

- Continuously improving procedures and standards to keep pace with technological advancements and emerging threats.

- Providing regular training and awareness programs for employees, equipping them to identify and respond to potential risks such as phishing or fraud attempts.

- Ensuring strict compliance with regulatory requirements, including anti-money laundering (AML) and data privacy standards.

- Implementing advanced measures to safeguard sensitive customer data, such as encryption, multi-factor authentication, and regular security audits and IT risk assessments.

- Investing in disaster recovery and business continuity planning, enabling rapid response to unforeseen events such as cyber breaches or natural disasters.

By integrating these strategies into their operational framework, banks can not only mitigate risks but also build trust with their customers and stakeholders, ensuring long-term success in an ever-evolving industry.

Why BIA is Critical for Banks

Before we delve into the steps to perform a BIA, let’s first explore the key benefits it offers to banks. The most obvious advantage, as you might expect, is ensuring compliance with regulatory requirements, such as those outlined by the FFIEC.

However, regulatory compliance is just one of many benefits. A well-executed BIA helps banks enhance their resilience against disasters and operational disruptions. This improved preparedness allows them to provide uninterrupted services to customers, fostering greater trust.

For instance, conducting a BIA enables banks to:

- Identify vulnerabilities and gaps in their infrastructure, helping prioritize risk mitigation strategies.

- Minimize downtime during a crisis, ensuring continuity of critical operations.

- Strengthen disaster recovery planning, leading to faster and more efficient responses to unexpected events.

By leveraging the insights gained from a BIA, banks can create a more secure and reliable operational environment, benefiting both the institution and its clients.

A Step-by-Step Guide to BIA for Banks

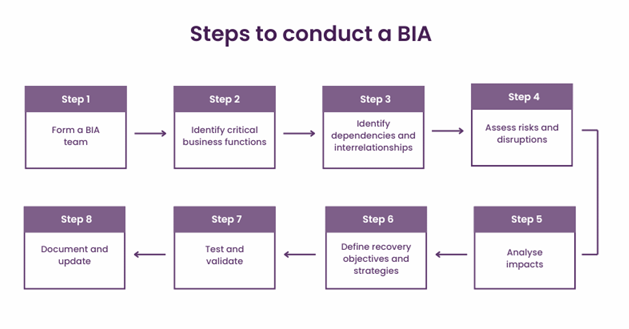

In this section, let’s delve deeper into the concept of BIA and its purpose. As mentioned earlier, management should conduct a BIA to identify all business functions across departments and prioritize their recovery based on their criticality during a disaster. Below are the steps to achieve the objectives of BIA:

1. Identify Critical Business Functions

Each department manager should confirm the list of critical functions within their department. This step includes taking an inventory of the bank's critical assets, such as hardware, software, cash reserves, and other vital components. Since the functions keep changing, it is important to maintain an up to date inventory.

2. Analyze Interdependencies

Once critical functions have been identified, it is crucial to analyze their interdependencies with other systems and processes. For example, a bank’s wire transfer function may be directly dependent on its core banking software. Understanding these relationships allows for more effective recovery planning, ensuring that disruptions in one area do not create cascading failures across multiple functions. By mapping both upstream and downstream dependencies, organizations can pinpoint critical applications or services that, if disrupted, could significantly impact other essential operations.

3. Determine Recovery Times

For each business process and system, banks must establish key recovery metrics, including:

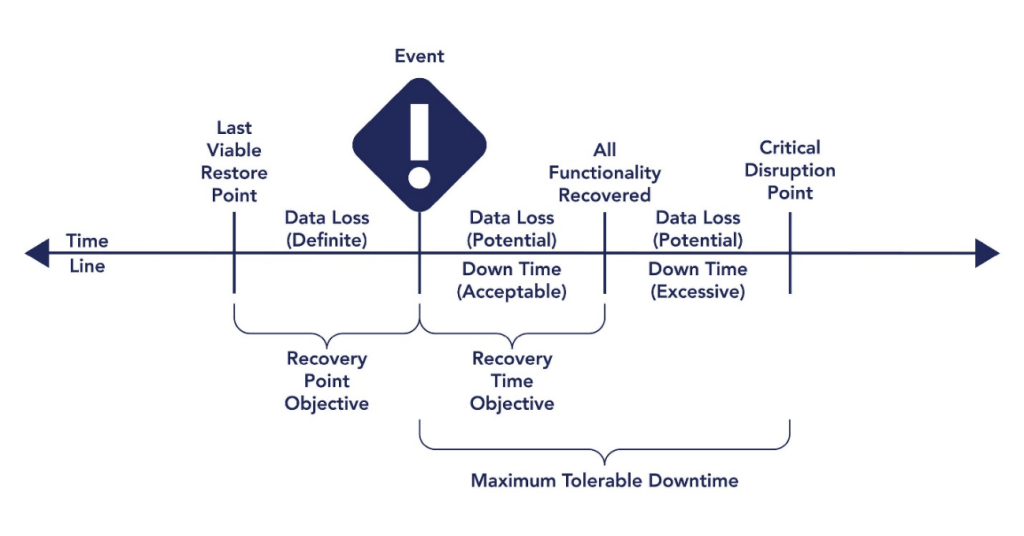

a. Maximum Tolerable Downtime (MTD): The longest duration a process can be non-operational without causing significant harm. This metric can be very useful in determining whether a function is critical or not.

b. Recovery Time Objective (RTO): The time it takes to restore functionality. This cannot exceed the MTD value of a function.

c. Recovery Point Objective (RPO): The maximum acceptable data loss measured in time. This metric can help the banks guide their backup frequency.

As illustrated in Figure 1, exceeding the MTD can result in severe financial and non-financial repercussions. For critical data, banks should consider mirroring it to a remote data center. The RTO largely depends on the IT team’s capabilities.

4. Identify Required Resources

To ensure the successful recovery of critical business functions, banks must evaluate and plan for any specialized or additional resources that may be needed during a disruption. This includes personnel, software, hardware, and other essential tools required to restore operations efficiently.

If certain functions cannot be recovered using the bank’s internal resources alone, it is crucial to identify and document third-party vendors that may be needed for support during a crisis. Proactively establishing these contingency plans helps minimize downtime and ensures a swift and coordinated response during unforeseen disruptions.

5. Evaluate Impact

Banks must analyze both the financial and non-financial impacts of disruptions:

a. Financial impacts: Loss of revenue, regulatory penalties, recovery costs for lost transactions, etc.

b. Non-financial impacts: Compliance failures, damage to reputation, employee morale, and stakeholder confidence.

6. Conduct an IT Risk Assessment

Banks should evaluate the likelihood and potential impact of various disruptions. This includes identifying threats such as:

a. Natural events: Fires, hurricanes, earthquakes, etc.

b. Technical events: Power outages, hardware failures, software glitches, etc.

c. Cyber threats: Malware attacks, phishing scams, data breaches, etc.

7. Define a Recovery Path

During a disruption, recovering everything simultaneously is not feasible. Therefore, creating a structured recovery path is critical. Banks should prioritize processes based on risk impact, recovery times, and resource requirements. The focus should be on restoring the most critical processes with the shortest RTO and the highest impact value first.

By following these steps, banks can ensure a well-rounded and effective BIA process, equipping them to handle disruptions with minimal impact on operations and customer trust.

Real-World Scenarios: How BIA Helps in Banking Crises

While working with one of the largest banks in South Florida, we recently encountered a real-world scenario that highlights the importance of preparedness. We had just completed a BCP tabletop exercise designed to test the availability of systems during a disaster. Following the exercise, the bank identified gaps in its communication protocols and BCP strategies, allowing them to address these vulnerabilities before facing an actual crisis.

Shortly after the simulation, the infamous CrowdStrike IT outage occurred, causing several of the bank’s services to go offline. However, thanks to their preparation for such critical third-party outages, the bank swiftly informed its customers and implemented alternative solutions to ensure continuity of services.

Another real-world scenario, a bank that had not conducted a BIA in several years faced significant challenges during a disaster. In the 2024 hurricane season, Hurricane Milton caused widespread flooding, forcing the closure of multiple bank branches. Since employees had not been adequately trained to handle such situations, the bank suffered both financial and operational setbacks.

Customers grew increasingly frustrated due to the lack of official communication from the bank. There were no updates on its website or social media channels regarding when services would resume. Additionally, with the bank’s ATMs unavailable, customers were forced to use ATMs from other banks, incurring out-of-network fees. The lack of preparedness and communication led to severe reputational damage, as disgruntled customers voiced their frustration across social media, further impacting the bank’s credibility and trust.

Common Pitfalls and How to Avoid Them

Now that we have discussed the benefits and steps of performing a BIA, let’s explore some common mistakes that banks often make during the process. These pitfalls can hinder the effectiveness of the BIA and leave banks unprepared for potential disruptions. Some of the most frequent issues include:

- Overestimation: Many department managers tend to assume that all their functions are critical to the bank's operations. While each function has its importance, not all can be classified as critical. To address this, it is essential to establish clear criteria for defining critical functions and assets.

- Failure to Account for All Threats: Another common mistake is neglecting to consider the full range of business threats during the IT risk assessment. Banks must include all potential events that could disrupt their operations, whether they stem from natural disasters, technical failures, or cyberattacks.

- Neglecting Regular Updates: Some banks mistakenly believe that performing a BIA once is sufficient. However, the threat landscape is constantly evolving, and banks frequently add or retire functions and services. To stay prepared, it is crucial to update the BIA regularly to reflect these changes and address emerging risks.

- Incorrectly defining recovery objectives: When determining RTO and RPO values for restoring a business function, it is crucial to align them with the IT team’s actual capabilities. The RPO, in particular, is heavily dependent on the frequency of data backups. For instance, if a database is continuously mirrored at a remote site, the RPO can be as low as zero minutes. However, if backups are only performed nightly, the RPO could extend to 24 hours, significantly impacting data recovery strategies. Miscalculating these values can lead to extended downtimes and potential data loss during a disruption.

- Incorrect Methodology: Many banks attempt to conduct BIA internally but often fail to follow a structured methodology, leading to compliance issues and potential failures in external audits by regulatory bodies. A thorough BIA requires input from department managers, IT teams, and the steering committee to ensure a comprehensive assessment of business functions and dependencies. Engaging external vendors with expertise in conducting BIAs across multiple organizations is highly recommended, as they bring industry best practices, regulatory insights, and an objective perspective to the process.

- Lack of Testing: Conducting a BIA is just the initial step in developing an effective BCP. However, without regular testing, the plan remains theoretical and may fail in a real-world scenario. It is essential to perform various types of testing, such as full-interruption tests and tabletop exercises, to evaluate the effectiveness of both the Disaster Recovery Plan (DRP) and BCP. Unfortunately, many banks neglect these critical exercises, leaving them unprepared when an actual disaster strikes. Regular testing ensures that employees understand their roles, response procedures are refined, and potential gaps in the plan are identified before a crisis occurs.

Embracing BIA for a Secure Banking Future

In conclusion, conducting a BIA is not merely an option but a necessity for banks operating in today’s ever-evolving landscape. Regularly performing a BIA using the correct methodology ensures that banks can adapt to emerging risks, maintain resilience, and protect their operations against disruptions. A well-executed BIA not only helps mitigate potential revenue losses but also safeguards the bank’s reputation by ensuring continuity of services during crises.

Moreover, a robust BIA process fosters customer trust and stakeholder confidence, which are critical for a bank’s growth and long-term success. Ultimately, integrating BIA into the bank's risk management strategy is an investment in both resilience and growth, ensuring the institution’s ability to thrive even in the face of uncertainty.

ERMProtect Can Help with BIAs and IT Risk Assessments

ERMProtect has been conducting IT risk assessments since its founding in 1998. We have the expertise and experience required to help your organization navigate regulatory, security, and risk issues.

Please contact Silka Gonzalez at [email protected], Judy Miller at [email protected] or call 305-447-6750 to set up a free consultation on the type of IT risk assessment that would best protect your business.

Divyansh Arora is an Information Security Manager at ERMProtect Cybersecurity Solutions where he performs vulnerability assessment and penetration testing, along with PCI DSS assessments for various clients across the globe. He holds a master’s degree in information technology – Information Security from Carnegie Mellon University.

Subscribe to Our Weekly Newsleter

Intelligence and Insights

Are You Prepared for an AI-Powered Cyber Attack?

AI Privacy Risks