The financial industry is among the most targeted industries, when it comes to cybersecurity attacks, along with federal government organizations, higher education institutions, and retail organizations.

Even a single attack can have devastating consequences, and not just in terms of financial losses. Cybersecurity attacks can halt the functioning of entire systems, and make your services inaccessible to your customers for days and weeks.

Not only do the financial losses due to hacker demands, loss of business and security refurbishing add up, your organization loses trust, and may also be subject to fines or other regulatory consequences.

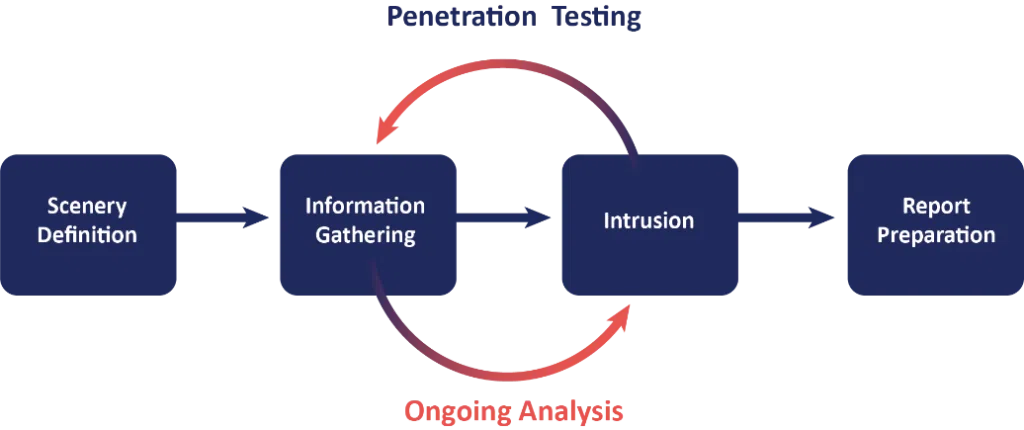

Choosing the right penetration testing firm can help prevent damaging cybersecurity events. A penetration or pen test involves a qualified pen testing firm attempting to gain access to your systems, and testing your levels of security. Aside from ensuring compliance with PCI DSS (Payment Card Industry Data Security Standard) and GLBA (Gramm-Leach-Bliley Act) norms, experienced and qualified pen testing firms can identify gaps in your security measures, and help you understand which parts of your systems are the most vulnerable to an attack.

Some of the most common cybersecurity attacks that banks and financial institutions can be vulnerable to, include:

Compromised Supply Chain

Even if your own systems are as secure as possible, cybercriminals could choose to attack you by targeting your vendors or suppliers, so you receive compromised software or hardware. Not only does this type of attack make more financial sense for threat actors, who are able to gain access to multiple organizations by targeting a single vendor, it can also be difficult to protect against, since it involves a third party.

Bank of America was targeted last year in a supply chain attack, after one of their service providers, Infosys McCamish Systems, suffered a security breach. Over 57,000 users were directly affected by the breach. Another supply chain cyberattack, involving Russian hacking syndicate Cl0p, left large banking and financial organizations such as Deutsche Bank, Dow Credit Union, TD Ameritrade, and Charles Schwab exposed, in 2022. A single supply chain attack costs an organization $4.4 million on average.

Attacks involving the exploitation of a third-party relationship are among the major security threats organizations across all industries face, according to a global threat report released in 2023. The report points out that the high ROI (return on investment) potential of these attacks is likely to motivate many attempts to compromise the software and hardware supply chain throughout 2024.

Phishing and Social Engineering Attacks

Hackers can obtain sensitive data such as passwords and login information through dedicated phishing attacks that involve sending emails, text messages, or other communication purporting to be from legitimate sources, containing fraudulent links. These kinds of attacks are among the biggest threats to your security, because they involve human error. Employees can be the weakest link in your security system, especially if they have not received adequate training on security best practices.

Phishing attacks are common across all industries, and an estimated 90% of all cybersecurity breaches begin with a phishing attack. Artificial Intelligence (AI) has made phishing more sophisticated and advanced, and made it easier for threat actors to craft far more convincing emails, texts and voice messages. In 2022, a massive social engineering attack that originated in Brazil, affected bank users in Portugal, Spain, Brazil, Mexico, Chile, the UK, and France.

While regular training can help improve staff security practices, a pen test can identify the weakest points in your security, and alert you and your staff to the possibility of an actual data breach event, and how to prevent it.

Cloud Security Threats

More and more organizations are outsourcing part or most of their data and systems storage to cloud services. While cloud services can be very secure, as they have their own cybersecurity standards and certifications to maintain, organizations using cloud services must not grow complacent and assume their data is completely safe on the cloud.

The cloud banking market is expected to grow by 16.32% annually until 2032, but over 40% of global IT decision makers believe that cloud service providers are responsible for data security in the cloud. Neglecting to focus on cloud security can be quite dangerous for banks and financial organizations. In 2019, over 100 million credit card applications were stolen from CapitalOne, in a breach involving their cloud provider, AWS.

According to the Global Threat Report 2024, there has been a significant increase in “intrusions” involving the cloud, and threat actors are now far more aware of the ability to compromise cloud workloads, both of which point to increased cloud security incidents in the years to come.

Banking organizations must supplement the safety measures taken by the cloud vendors they use, and have regular cloud penetration tests conducted.

DDoS Attacks

A DDoS (Distributed Denial-of-Service) attack is performed by overwhelming a server, website or service with traffic from illegitimate sources, so that legitimate customers can no longer access the service. When a banking website or application is subjected to a DDoS attack, customers find themselves faced with very slow website response times, or may not be able to access their accounts at all. The bank or financial organization is then forced to capitulate to the demands of the attackers, and fulfill extortionary demands for money, or information.

Not only are DDoS attacks frustrating events in themselves, they can also be used to distract security teams from other attacks that hackers may use to gain access to bank funds, or sensitive financial information. According to a report, over a third of the DDoS attacks occurring in 2023 were aimed at banks and financial organizations, and the cost of a single DDoS attack averages out to $1.8 million.

Ransomware Attacks

Ransomware attacks are among the most common ways of targeting banks and financial institutions. In 2023, ransomware attacks targeting banks and financial institutions rose 64%, and overall ransomware attacks increased by 37%. With the advent of Raas (ransomware as a service), threat actors are now increasingly offering their malicious software to other parties, in exchange for payment or a part of the ransom, making it easier and quicker to breach systems.

In a ransomware attack, hackers use malware to encrypt or gain control of critical systems, and demand a ransom in exchange for restoring normal functioning. These attacks are often combined with encryption and exfiltration, for maximum impact, and to exert more pressure upon the targeted organizations. The average ransom demand across all industries is $5.3 million.

An IMF survey found that 56% of central banks and supervisory authorities do not have a national cyber strategy, and over 60% do not mandate testing and other cybersecurity best practices.

Keeping Your Organization Safe from Cyber Attacks

With threat actors developing more advanced techniques, banks and financial organizations need to upgrade their security levels to prevent falling victim to a costly data breach. Some of the most important things to keep in mind are:

- Invest in frequent and comprehensive security training for your staff, who can often be the weak link when it comes to security.

- Do not neglect cloud security, or leave it up to the cloud provider. Ensuring regular vetting of the security practices of cloud vendors and other third-party vendors can help root out weak links.

- Choose the right pen testing firm, and ensure they conduct comprehensive and rigorous pen tests that focus on all aspects of security, from internal practices and systems, to external vendors.

Hiring experienced penetration testing companies to conduct regular and thorough pen tests on your security systems can keep them secure and impenetrable by hackers. Pen testing firms use a variety of techniques to test the defenses of your system, and attempt to gain access in the same ways a hacker would. Regular pen tests can uncover weakness in your system, allowing your cybersecurity team to plug them before any damage is done.

While it is a great idea for your staff to follow security best practices such as changing default passwords, maintaining strong passwords, and being suspicious of external emails or doubtful links, it may not be enough to keep your systems truly secure. Hackers have very sophisticated techniques and ways of gaining access, and are always working on improving the effectiveness of their techniques. Pen testing firms can help make you aware of any new vulnerabilities that have come up due to hacking techniques growing more advanced, and help you constantly upgrade the security of your systems.

Although hiring reputed and qualified pen testing firms does come at a cost, it is well worth it to prevent cybersecurity incidents which could prove far more costly, and damage your reputation and dependability.

Find out more about ERMProtect’s pen testing services. Our experienced and professionally certified pen testers can help you ensure you aren’t leaving any doors open for hackers and other threats.

Contact Judy Miller at [email protected] or call 305-447-6750 to set up a free consultation.