From Compliance to Advantage: Using PCI 4.0 Certification to Boost Business Value

By Rey LeClerc Sveinsson, PhD

In today’s digital marketplace, where cyber threats loom large and data breaches are costly affairs, Payment Card Industry Data Security Standard (PCI DSS) compliance is not just a regulatory necessity – it’s a strategic advantage.

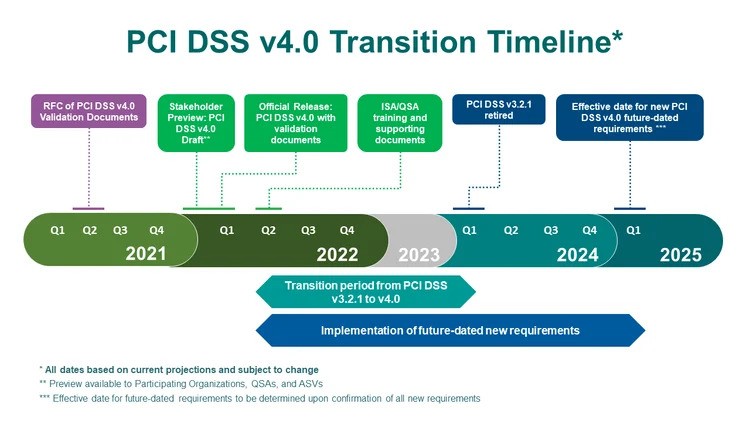

The latest iteration, PCI DSS 4.0, introduces security requirements that can significantly bolster a company's security posture. While the process of aligning with these standards may seem daunting, achieving PCI 4.0 certification offers businesses a unique opportunity to enhance customer trust, strengthen brand reputation, and create a competitive edge in the marketplace.

This article explores how businesses can leverage PCI 4.0 certification to transform compliance obligations into substantial business benefits.

Enhancing Customer Trust Through Proven Security Standards

One of the most direct benefits of achieving PCI 4.0 certification is the enhanced level of trust it instills in customers. In an era where consumers are increasingly concerned about privacy and data security, demonstrating compliance with the latest PCI standards serves as a testament to a business’s commitment to protecting sensitive information.

Transparency and Assurance

Transparency and assurance are critical components in building and maintaining customer trust, especially in industries such as e-commerce where transactions are entirely digital and security concerns are paramount.

By actively communicating their compliance with PCI DSS 4.0, businesses signal to customers that they are committed to safeguarding sensitive cardholder information using the most current and rigorous standards available.

Transparency about PCI DSS 4.0 compliance offers more than just assurance — it is a strategic approach to customer engagement and market positioning. By demonstrating their commitment to the highest security standards, businesses not only alleviate consumer anxieties but also enhance their overall reputation and trustworthiness.

In the digital shopping landscape, where consumer confidence is as crucial as the quality of the products sold, such transparency becomes a powerful tool for building lasting customer relationships.

Enhanced Customer Experience

Creating a secure transaction environment is crucial not just for meeting compliance standards like PCI DSS 4.0, but also for enhancing the overall customer experience.

Consumers are justifiably concerned about the security of their online transactions. A business that demonstrates a commitment to security not only reassures its customers but also provides a smoother, interruption-free shopping experience.

A secure transaction environment is a significant business advantage. By investing in advanced security measures and ensuring compliance with standards such as PCI DSS 4.0, businesses can enhance the customer experience, foster loyalty, and ultimately drive growth.

Differentiating the Business in a Competitive Market

PCI 4.0 compliance can serve as a key differentiator in industries where consumers have a plethora of choices. Companies can leverage their compliance status not just as a badge of honor but as a core part of their value proposition.

Marketing the Security Standard

Marketing PCI DSS 4.0 compliance effectively as part of a business's promotional strategy can significantly enhance market position and brand perception, particularly in B2B environments where the stakes of a data breach are notably high. Leveraging compliance as a key differentiator not only highlights a company's commitment to data security but also reassures potential partners and clients of its reliability as a safe handler of sensitive information.

Effectively marketing PCI DSS 4.0 compliance allows businesses to fulfill a regulatory requirement while also turning it into a compelling advantage in the competitive landscape.

In B2B environments, where the consequences of data breaches can be particularly severe and wide-reaching, positioning a company as a secure, compliant entity is not just beneficial - it is often crucial for securing and maintaining client relationships. This strategy supports long-term business growth by building sustained trust and reliability in the market.

Building Partner Confidence

In the business-to-business (B2B) realm, where transactions often involve the exchange of sensitive information and substantial financial stakes, the assurance of robust security practices is paramount.

PCI DSS 4.0 certification plays a critical role in establishing this assurance, acting as a cornerstone for building and sustaining partner confidence. This certification not only signals compliance with stringent security standards but also communicates a proactive approach to data protection that can influence partnerships and collaborative efforts in profound ways.

For businesses that rely on building and maintaining strong B2B relationships, PCI 4.0 certification is a strategic asset. It eases the complexities of contract negotiations and paves the way for new collaborations and market opportunities. By maintaining this certification, businesses signal their ongoing commitment to data security excellence, fostering trust and credibility that can substantially impact their growth and success.

Optimizing Business Operations and Reducing Costs

Beyond marketing and customer trust, PCI 4.0 certification can lead to significant operational efficiencies and cost savings. This is because achieving compliance requires a review and, often, an overhaul of IT systems and processes, leading to more streamlined operations.

Reducing Risk and Associated Costs

Adhering to the stringent security protocols outlined in PCI DSS 4.0 is not just about compliance. It is a proactive measure that significantly mitigates the risk of data breaches and the high costs associated with such incidents.

This protective stance offers substantial benefits in terms of cost savings and risk management. By exploring how compliance reduces risks and associated costs, businesses can appreciate the full value of integrating PCI 4.0 standards into their operational frameworks.

In essence, PCI 4.0 compliance is an investment that pays dividends by safeguarding against the myriad costs associated with data breaches. By integrating PCI standards into daily operations, businesses enhance their security posture but also fortify their financial stability and customer relations. The proactive approach to compliance depicted by PCI 4.0 standards illustrates a shift from reactive security practices to a more strategic, risk-averse stance that benefits all stakeholders involved.

Operational Efficiency

Adopting PCI DSS 4.0 compliance can significantly enhance the operational efficiency of a business's IT operations. The integration of advanced security technologies and practices mandated by this standard streamlines processes, optimizes resource allocation, and sharpens the focus of IT teams on strategic initiatives that drive business growth.

The integration of the stringent, yet forward-thinking security technologies and practices required for PCI 4.0 enhances security and significantly improves the efficiency of IT operations. This shift not only mitigates risks but also transforms IT departments into strategic hubs that contribute to broader business objectives, paving the way for growth and innovation in an increasingly digital business environment.

Futureproofing the Business

PCI 4.0 compliance prepares businesses for future security challenges. As cyber threats evolve, having a robust compliance framework allows businesses to adapt more quickly to new security challenges.

Scalability with PCI DSS 4.0

The scalability of security systems and processes is a critical aspect for businesses that anticipate growth and face an ever-evolving threat landscape. PCI DSS 4.0 has been designed with these considerations in mind, offering a framework that not only meets current security needs but also adapts to future demands as organizations expand and as cyber threats become more sophisticated.

The flexibility and rigorous nature of PCI 4.0 standards prepares organizations for future growth and evolving threats. For businesses looking to scale, PCI 4.0 offers a framework that supports expansion while ensuring that security measures evolve in step with both the business and the broader cyber threat environment.

This scalability is essential for maintaining a secure, compliant, and competitive stance in the marketplace.

Continual Improvement with PCI DSS 4.0

The concept of continual improvement is central to the ethos of PCI DSS 4.0, emphasizing not just compliance but an ongoing enhancement of security measures to meet evolving challenges.

This approach helps businesses align with current security standards and anticipate and mitigate future risks. The continual improvement principles embedded in PCI 4.0 create a dynamic and adaptive security environment within businesses.

By embracing regular audits and fostering a culture of ongoing enhancement, businesses prepare themselves to meet future security challenges effectively. A business’s defenses evolve in step with - or remain a step ahead of - the rapidly changing cyber threat landscape, securing its operations and its future.

PCI 4.0 Certification and Your Business

Turning PCI 4.0 compliance into a competitive advantage requires a shift in perspective from viewing compliance as an obligatory cost to seeing it as an investment in the business’s future.

By enhancing customer trust, differentiating the business in the market, optimizing operations, and preparing for future challenges, PCI 4.0 certification can significantly enhance the overall value and sustainability of a business. Thus, compliance not only meets a regulatory requirement but also strategically positions the business for long-term success.

How Can ERMProtect Help

ERMProtect can be an invaluable asset for businesses seeking to achieve and maintain PCI DSS 4.0 compliance while leveraging it to enhance business value and competitive advantage.

ERMProtect is more than just a compliance service provider. We are a strategic partner helping businesses transform the necessity for PCI compliance into an opportunity for enhancing security, trust, and competitive advantage.

With ERMProtect, businesses can not only meet the stringent requirements of PCI DSS 4.0, but also set a foundation for ongoing success and resilience. Contact [email protected] for more information.

About the Author

Dr. Rey Leclerc Sveinsson is an expert in Privacy and Data Protection, Information Security, and Technology Governance, Risk & Compliance (IT GRC). He has developed information assurance programs for major organizations globally during his career as well as serving as a Consultant for ERMProtect. He has a PhD in Information Systems and multiple master’s degrees in the areas of privacy, information technology, and cybersecurity laws.

Subscribe to Our Weekly Newsletter

Intelligence and Insights

Quantum Computing Puts Today’s Encryption at Risk

Are You Prepared for an AI-Powered Cyber Attack?