Why PCI Standards Are Just the Starting Point for Securing Payment Data

By Rey LeClerc Sveinsson, PhD

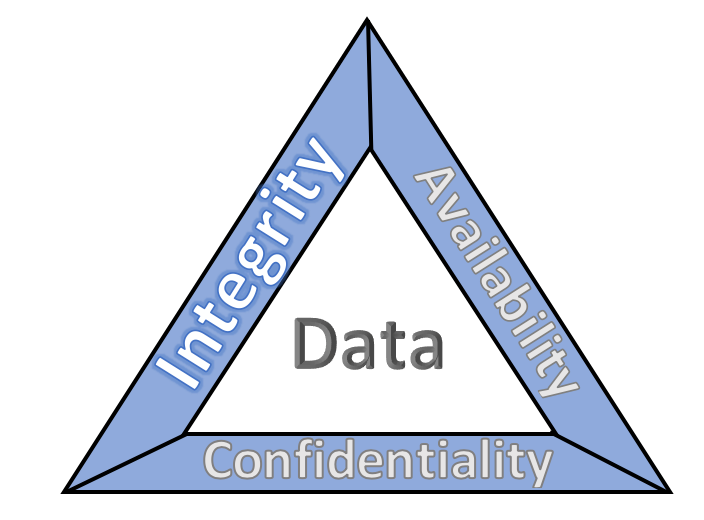

In today’s digital economy, the need to secure payment data is more critical than ever. With cyber threats evolving in sophistication, businesses must go beyond compliance with Payment Card Industry Data Security Standards (PCI DSS) to ensure robust protection of sensitive payment data.

While PCI DSS compliance offers a solid baseline, it is not an all-encompassing solution. By integrating additional security measures such as real-time threat monitoring, AI-driven anomaly detection, and advanced encryption technologies, organizations can build a proactive and resilient data security framework.

Understanding PCI DSS Compliance: The Foundation of Payment Data Security

PCI DSS is a set of security standards designed to protect payment card information during processing, storage, and transmission. Mandated by major credit card companies, it aims to reduce fraud and data breaches. Compliance with PCI DSS involves meeting specific requirements, including:

1. Building and Maintaining Secure Networks (e.g., Firewall Configurations)

Purpose: To prevent unauthorized access to sensitive systems, including payment processing environments.

A secure network infrastructure acts as the first line of defense against cyber threats. Firewalls and similar network security devices are configured to block unauthorized traffic and ensure only legitimate communication occurs within and between networks.

2. Protecting Cardholder Data with Encryption

Purpose: To safeguard cardholder data from being compromised, even if intercepted by attackers.

Encryption ensures that sensitive payment card data, such as primary account numbers (PANs), cannot be intercepted or accessed in a usable form. PCI DSS mandates encrypting data during transmission (e.g., over public networks) and storage.

3. Maintaining a Vulnerability Management Program Through Regular Updates

Purpose: To reduce the risk of exploitation by attackers who often target outdated or unpatched systems.

Software and systems must be regularly updated to address known vulnerabilities. A vulnerability management program ensures that organizations proactively identify, evaluate, and address security weaknesses.

4. Implementing Strong Access Control Measures

Purpose: To minimize the risk of unauthorized access and insider threats.

Access control involves limiting access to systems and data based on the principle of least privilege—users and systems should only have access to what they need to perform their roles. Examples include unique user IDs for accountability, restricted physical and digital access to sensitive areas.

5. Monitoring and Testing Networks Regularly

Purpose: To ensure that any anomalies or vulnerabilities are quickly identified and remediated.

Continuous monitoring (e.g., using log analysis tools) and regular testing (e.g., penetration testing and vulnerability scans) ensure that networks remain secure over time. This requirement helps detect suspicious activity and evaluate defenses against potential attacks.

6. Maintaining an Information Security Policy

Purpose: To create a culture of security and provide employees with clear guidelines for protecting sensitive information.

A formalized information security policy outlines the organization's commitment to data security, specifying roles, responsibilities, and procedures for safeguarding payment data.

These six points are the pillars of PCI DSS, designed to reduce risks associated with handling payment card information. They provide a structured approach to ensuring that organizations establish, monitor, and maintain a secure environment for processing, storing, and transmitting sensitive payment data. Besides forming a robust foundation, they ensure that basic security measures are in place.

However, they represent a minimum standard. As cyber threats escalate, relying solely on compliance can leave gaps in an organization's security posture.

The Limitations of PCI DSS Compliance

While PCI DSS compliance is a cornerstone of payment data security, it is not a comprehensive solution capable of addressing every potential risk in today’s dynamic threat landscape. Its structured guidelines provide essential safeguards, but the evolving nature of cyber threats and organizational vulnerabilities necessitate a more robust and proactive security strategy.

Let’s delve deeper into why PCI DSS alone is insufficient and explore the need to go beyond compliance.

1. Sophisticated Threats

Modern cybercriminals employ advanced methods that go far beyond the basic hacking techniques PCI DSS was initially designed to counter. For example:

- AI-Driven Attacks: Cybercriminals use artificial intelligence to conduct attacks like:

- Adaptive Phishing Campaigns: AI analyzes user behavior to craft convincing phishing emails that evade detection.

- Automated Vulnerability Exploitation: AI tools can rapidly scan and exploit vulnerabilities in systems before traditional defenses react.

- Ransomware as a Service (RaaS): This rapidly growing industry allows even less skilled attackers to launch highly effective ransomware campaigns, targeting payment data environments

Static, compliance-driven security measures like annual assessments or periodic scans may not detect or prevent these adaptive, real-time threats. Without additional layers of intelligence-driven defense, organizations remain vulnerable.

2. Lagging Updates

The PCI DSS framework, while rigorous, does not always keep pace with the speed of technological change or the emergence of new attack vectors. Some key challenges include:

- Update Cycles: PCI DSS updates are not immediate. Between revisions, organizations might face threats that the standard doesn’t explicitly address. For instance, the rise of contactless payments and mobile wallets introduced unique vulnerabilities that older versions of PCI DSS did not cover.

- Legacy Systems: Many organizations operate on legacy systems that meet compliance standards but are ill-equipped to handle modern threats like quantum computing advancements in cryptography.

Organizations that treat PCI DSS compliance as a one-size-fits-all approach may inadvertently leave gaps, particularly if they rely solely on the standard’s requirements without ongoing enhancements to their security strategy.

3. Human Error

While PCI DSS emphasizes technical and operational controls, it cannot entirely mitigate human-related risks, such as:

- Employee Negligence: A compliant organization may still face data breaches if an employee:

- Fails to recognize a phishing email and inadvertently shares sensitive access credentials.

- Misconfigures systems or neglects updates.

- Insider Threats: Malicious insiders, such as disgruntled employees or contractors, can exploit their access privileges to exfiltrate payment data. PCI DSS cannot prevent intentional misuse if proper monitoring and behavioral analysis are absent.

Human error underscores the need for ongoing training, cultural emphasis on cybersecurity, and additional safeguards like behavioral monitoring tools that go beyond compliance.

4. Emerging Threats and Industry-Specific Risks

Organizations operate in unique environments, each with specific challenges and vulnerabilities that PCI DSS may not directly address:

- Industry-Specific Risks:

- E-commerce platforms face bot-driven fraud at a massive scale, requiring tailored defenses like bot mitigation software.

- Healthcare organizations processing payment data must also consider HIPAA compliance, which introduces overlapping but distinct security requirements.

- Threat Evolution:

- Emerging threats such as supply chain attacks target third-party vendors, often bypassing PCI DSS requirements applied only to internal systems.

- Quantum computing on the horizon threatens traditional encryption algorithms, posing a long-term challenge, that PCI DSS does not yet address.

To address these risks, organizations must adopt proactive measures that account for their unique operational landscapes and leverage technologies designed to tackle emerging threats.

Leveraging PCI DSS as a Baseline for Advanced Security

Organizations should view PCI DSS compliance as a starting point rather than an endpoint. The standards provide a solid foundation, but the dynamic nature of cyber threats demands continuous improvement and additional layers of defense.

Here’s how organizations can build on PCI DSS to create a more comprehensive security framework:

1. Real-Time Threat Monitoring

Real-time monitoring provides organizations with the ability to detect and respond to threats as they occur. This includes:

- 24/7 Network Monitoring: Deploying Security Operations Centers (SOCs) that continuously oversee network activity.

- Intrusion Detection Systems (IDS): Identifying unauthorized access attempts or anomalies in real time.

For instance, pairing PCI DSS requirements with real-time monitoring tools can prevent breaches before they escalate. Unlike periodic vulnerability assessments, continuous monitoring ensures organizations are alerted to potential threats immediately.

2. AI-Driven Anomaly Detection

Artificial intelligence (AI) is transforming the cybersecurity landscape by enabling anomaly detection at scale. AI-driven systems can analyze vast amounts of data to identify deviations from normal patterns, such as:

- Unusual Login Attempts: Multiple failed login attempts or logins from unusual geographic locations.

- Transaction Anomalies: Uncharacteristic purchase patterns that could indicate card fraud.

By integrating AI capabilities, businesses can quickly identify and mitigate threats that static compliance measures might miss.

3. Enhanced Encryption and Tokenization

While PCI DSS mandates encryption for data storage and transmission, advanced techniques such as tokenization and end-to-end encryption (E2EE) offer enhanced protection:

- Tokenization: Replaces sensitive payment data with unique tokens that hold no intrinsic value, minimizing exposure in the event of a breach.

- E2EE: Encrypts payment data from the point of entry to final processing, ensuring it remains secure throughout its journey.

These measures go beyond PCI DSS requirements, reducing the attack surface and safeguarding against interception.

4. Multi-Factor Authentication (MFA)

PCI DSS requires strong access control measures, but integrating multi-factor authentication (MFA) significantly strengthens these defenses. MFA combines multiple verification methods, such as passwords, biometric scans and/or one-time codes.

Even if credentials are compromised, MFA ensures additional barriers prevent unauthorized access to sensitive systems.

5. Threat Intelligence Integration

Staying ahead of cyber threats requires a proactive understanding of the threat landscape. Organizations can leverage threat intelligence platforms to:

- Identify emerging vulnerabilities and attack vectors.

- Tailor defenses to address industry-specific risks.

- Share insights through collaborative networks to strengthen collective security.

PCI DSS compliance does not inherently include threat intelligence but integrating it can provide a competitive edge in mitigating advanced threats.

Developing a Culture of Security Beyond Compliance

Building a robust data security framework is not just about implementing technology — it’s about fostering a culture of security within the organization. This involves:

- Continuous Training and Awareness: Employees are often the weakest link in cybersecurity. Regular training programs ensure staff understand the latest threats, compliance requirements, and their role in safeguarding data.

- Regular Security Audits: Beyond annual PCI DSS assessments, organizations should conduct internal and third-party audits to identify and address vulnerabilities continuously.

- Incident Response Planning: An effective incident response plan (IRP) enables organizations to act swiftly in the event of a breach. This includes clear escalation paths, defined roles and responsibilities and regular testing of response protocols. A robust IRP ensures that when threats bypass defenses, the impact is minimized.

The Business Benefits of Going Beyond Compliance

Taking a proactive approach to payment data security offers numerous benefits beyond compliance, including:

- Enhanced Customer Trust: Demonstrating a commitment to data security fosters customer confidence and loyalty.

- Reduced Financial Impact: Advanced security measures lower the risk of costly data breaches and regulatory fines.

- Competitive Advantage: Businesses that exceed compliance standards differentiate themselves in the market as leaders in security.

Building Resilience in an Evolving Threat Landscape

Compliance with PCI DSS alone is not sufficient to protect sensitive payment data. While PCI DSS provides a solid foundation for basic security, it must be viewed as a starting point rather than an endpoint.

Organizations must implement additional measures, such as real-time threat monitoring, AI-driven anomaly detection, and advanced encryption techniques, to safeguard against increasingly sophisticated attacks that can bypass static compliance measures.

Real-time monitoring ensures immediate detection and response to suspicious activity, minimizing the risk of breaches. AI-powered tools analyze patterns and flag abnormalities, providing an edge against attackers who leverage artificial intelligence in their strategies.

Advanced encryption techniques, including end-to-end encryption and tokenization, protect payment data throughout its lifecycle, ensuring robust defense even against future threats like quantum computing.

Beyond technology, fostering a culture of security within the organization is essential. Regular employee training, clear incident response protocols, and phishing simulations reduce human-related vulnerabilities such as negligence or insider threats.

Proactive security measures not only enhance protection but also build customer trust, ensure regulatory confidence, and save costs by preventing data breaches and their associated fallout.

Organizations that prioritize proactive and layered security strategies can adapt to emerging threats and safeguard their operations effectively.

By going beyond compliance, businesses not only protect their payment data but also demonstrate leadership in cybersecurity, securing their reputation and customer loyalty in an increasingly digital world.

Going Beyond PCI DSS Requirements with ERMProtect

ERMProtect helps organizations secure payment data and exceed PCI DSS requirements by offering advanced cybersecurity and compliance solutions. We simplify the compliance process through services such as gap assessments, vulnerability scans, and encryption deployment, enabling businesses to achieve PCI DSS efficiently and effectively.

Beyond compliance, ERM Protect strengthens organizations' defenses with tools like AI-driven threat detection, continuous network monitoring, and advanced encryption. Our tailored solutions address specific risks across industries, ensuring targeted protection against modern and emerging threats.

Recognizing the human element of security, ERMProtect fosters a culture of awareness through employee training, phishing simulations, and policy development. This holistic approach minimizes human-related vulnerabilities and ensures a secure payment ecosystem.

Partnering with ERMProtect empowers businesses to adopt a proactive cybersecurity strategy, building resilience against evolving risks while fostering customer trust and strengthening brand reputation in today’s digital landscape. Contact one of our PCI DSS compliance experts today to learn more.

About the Author

Dr. Rey Leclerc Sveinsson is an expert in Privacy and Data Protection, Information Security, and Technology Governance, Risk & Compliance (IT GRC). He has developed information assurance programs for major organizations globally during his career as well as serving as a Consultant for ERMProtect. He has a PhD in Information Systems and multiple master’s degrees in the areas of privacy, information technology, and cybersecurity laws.

Intelligence and Insights

Cybersecurity Blind Spot: Why Physical Security Is Now the Easiest Way In

Red, Blue, & Purple Teaming: Unified Strategy Organizations Can’t Ignore